Friday afternoon a bank run started at Silicon Valley Bank (SVB). Over the weekend we then saw Signature bank fail, and finally to top it all off on Monday morning the top 10 regional banks saw anywhere from a 40-60% selloff at the beginning of the day. It was a scary time, were we watching the complete implosion of the banking system? Was our money secure? Where do we put it if we can’t put it in banks? All of these were questions people were asking on Monday.

At around noon on Monday word started hitting the news cycle and Twitter that the Fed had backstopped the banks. Immediately 9 of the 10 regional banks recovered 20-40% in minutes. People’s deposits were to be secured and trust appeared to be tentatively restored in the banks. Time will tell just how much faith will be restored. As I write this today, banks stocks are still volatile but regional banks managed to end the second day mostly in the green, a selloff appears to have been averted. But questions remain. Did the fed just bail out the rich again? Is this the right thing to do? What is a backstop? Let’s dig into what the Fed did.

How banks work.

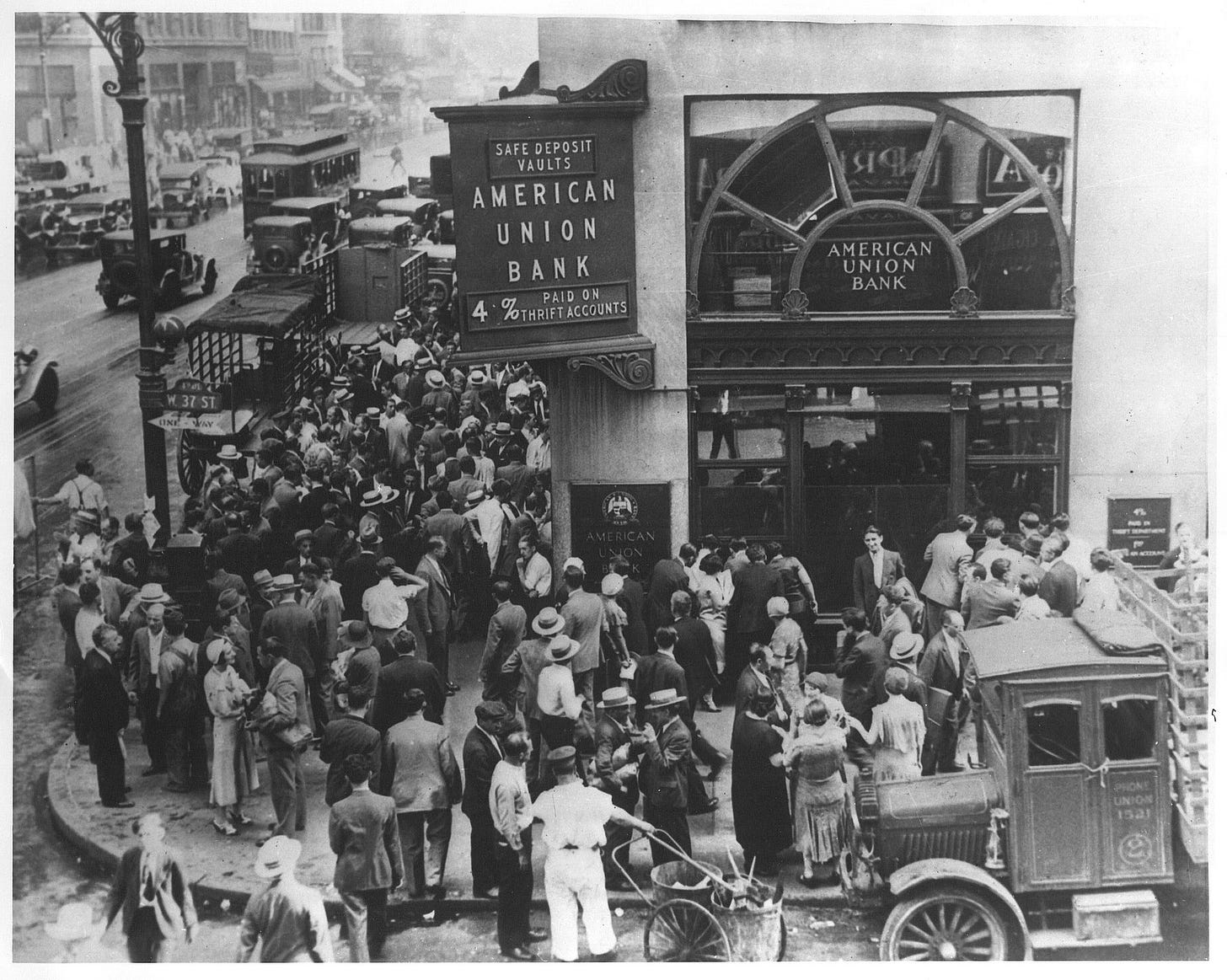

To understand how this backstop works we must understand how a bank run happens. In a bank when you deposit your money, the bank then takes that money and loans it out to another person or business, as well as the federal government, by buying treasuries. The bank then pays you a return, which lately has been essentially zero, to keep your money in their bank. This has been the age-old reason we use banks, to get a return, and to keep our money safe.

Banks are currently required to keep somewhere around 5% of their total deposits in cold hard cash. This is how they can fulfill your requests to withdraw $100 or $1000 out of your account. But when a bank run happens, many depositors attempt to withdraw their deposits into cash or transfer them to a different bank, and in the case of SVB, the depositors withdrew 25% of the bank's total assets on Friday.

Where a bank gets in trouble is when they only have 5% of their total deposits in cash, the other 95% is invested in things like 30-year loans on houses, or 5-year loans on cars, 1-year operating loans to your local bakery or farmer so they can bake your bread or grow your food and most importantly today 1-year to 10-year loans to the government through treasuries . This money isn’t available to the bank as cash. It’s locked up in investments, and yet people are trying to withdraw more money than the bank has in cash. And at that point the bank collapses.

But what about the FDIC?

Entering stage left into this little drama is the FDIC, the Federal Deposit Insurance Corporation. Created in 1933 because of bank runs in 1929, the US government passed a law that forced US banks to pay into a shared insurance fund that would back stop depositors’ losses in case of a bank collapse. In 1933 the total insured for a depositor by the FDIC was set at $2500 dollars. In the last 90 years that number has increased regularly with the most recent increase being in 2008 to $250,000.

The Fed Backstop to the rescue!

On Monday morning small business owners were looking for a guarantee that their money would be safe in their banks. And the only place that looked safe all weekend, and especially Monday morning was the “Too Big to Fail” banks. I’ve talked with multiple small business owners who were actively looking to move their money out of the smaller regional US banks Monday morning to the larger banks, US Bank, JP Morgan/Chase, Citigroup and the like.

Enter the Fed Backstop. Sunday evening the fed quietly released the following statement (1). Saying that they would backstop any bank with a loan against a basket of the bank’s owned eligible collateral (2) for up to one year's time. Why was this significant? Because the Fed introduced security and liquidity into the US banking sector, primarily backstopping the smaller regional banks who were most likely to see a bank run as small businesses pulled their money out looking for safety.

So how does the backstop work?

The fed backstop is extremely simple. So simple that it fits on a 1 page term sheet, and only has 4 pages of FAQs on how to use it. If a bank becomes the victim of a bank run, the Fed will give that bank a loan, up to the max amount of eligible collateral that the bank owns. This can be things like treasuries, mortgages the bank owns that meet federal lending standards, the list is long. But the key is, it specifically backs up the lending models of regional banks. Regional banks aren’t involved in Silicon Valley Startup Funding. They aren’t involved in complex currency swaps trading Euros for Dollars to offset the risk of the Ukrainian War.

As one regional bank CEO put it in a statement.

“Our deposits are held in 1.4 million accounts, and these accounts overwhelmingly tend to be smaller in size and operational in nature. Notably, the average balance of an account at Silicon Valley Bank was about 22 times the size of the average balance in our accounts, which made Silicon Valley Bank much more susceptible to the kinds of outflows they experienced last week. The situation was similar at Signature Bank.”

And now these banks have access to a short-term loan from the Federal Reserve to allow for people to get their money out yet gives the bank some breathing room to roll out of its longer-term investments to meet the demand of withdrawals from investors.

Isn’t this a bailout?

In short, no. Banks are not being given unlimited free money without payback requirements. The details are very clear:

A bank can only get a loan that is no greater than the total size of its eligible assets.

A bank can only get a loan for a term of up to 1 year. It’s not unlimited 0% money with no payback, like QE has been for over a decade.

The bank must pay an interest rate on the loan that is the one-year, overnight Fed funds rate plus 10 basis points (0.1%), a rate that has been ever increasing since the fed started raising a year ago.

This creates an extremely focused scope that banks aren’t going to leverage unless they absolutely must. Using today's rates, a bank would be costing themselves upwards of 8% in interest costs to use these loans. It is truly a tool of last resort that no bank is going to leverage unless it’s all that is left for the bank to stay afloat.

Edit: This has turned out to be incorrect. After much research and listening to people far smarter then I, this program still isn’t a bailout, but the terms are actually better then the Discount Window, costing them only the interest calculation above, and no collateral haircut (a collateral haircut is where the fed says the collateral you are posting is only worth 80%, so to get $100b in the discount window you have to put up $120b in collateral). So I expect a significant number of banks to leverage this program. But I still maintain that this is not a bailout, due to the terms mentioned above.

So what does this mean for the regular guy?

I’m going to couch this with this is my opinion and not investment advice.

I see the regional banks being extremely strong coming out of this. What Powell and the Fed has done is to strengthen regional banks in such a way, that should the Fed Backstop become a permanent program, and a bank keeps a marginal amount of its invested capital in the basket of eligible assets, treasuries, traditional mortgages, and other loans that have typically been in the purview of regional banks, there should be a near zero risk of those banks ever experiencing a bank run again.

There is a lot of Fear, Uncertainty, and Doubt (FUD) being spread around right now on the socials. Things like this is the nationalization of the banks, this is the last step before the consolidation of the banks into 5 massive banks. Please don’t listen to these. On Monday the Fed and the large banks had the regional banks right where they would have needed them if they wanted to take them over. If the Fed hadn’t lifted a finger on Sunday and let Monday go on with no backstop, we would have seen bank runs at all 10 of the regional banks, and the worst crisis in American banking since 1929. And the discussion today would be about which major banks are going to pick up the ruins from the regional banks.

In summary, I think what we have seen in the actions of the Fed has been to protect and grow regional banks to return America to the more traditional banking of the 50’s and 60’s. A place where a regional bank is no longer worried about international politics or having to manage currency carry trades in India. A place where a regional bank works to fund Tom’s local machine shop to buy a new piece of equipment, or helps Jim with an operational loan to get his farm seeded for this year's harvest, and is a place where you can get a car or home loan, and have it serviced by your bank for the entire length of the loan. A place where you can invest your money, have it grow at slightly less than inflation, but never again be worried if you were going to wake up in the morning to your money being inaccessible. And if this pie in the sky view seems crazy, well then Jerome Powell, leading the Fed, just might be a patriot trying to return America to a place it used to be, not the place it’s become.

1.) https://www.federalreserve.gov/newsevents/pressreleases/monetary20230312a.htm

Edit to reflect that the FDIC was started with a $2500 per depositor amount, and that it has increased to $250,000 over the intervening years.

Have you discussed the shroud of Turin? https://acts15church.substack.com/p/the-evidence

I have a question for everyone.

What's hard to believe in the Christian Bible? Please comment at https://acts15church.substack.com/p/hard-to-believe

Thank you. G'Day